04/05/2024: Elevate Your Financial Literacy with SavvyMoney

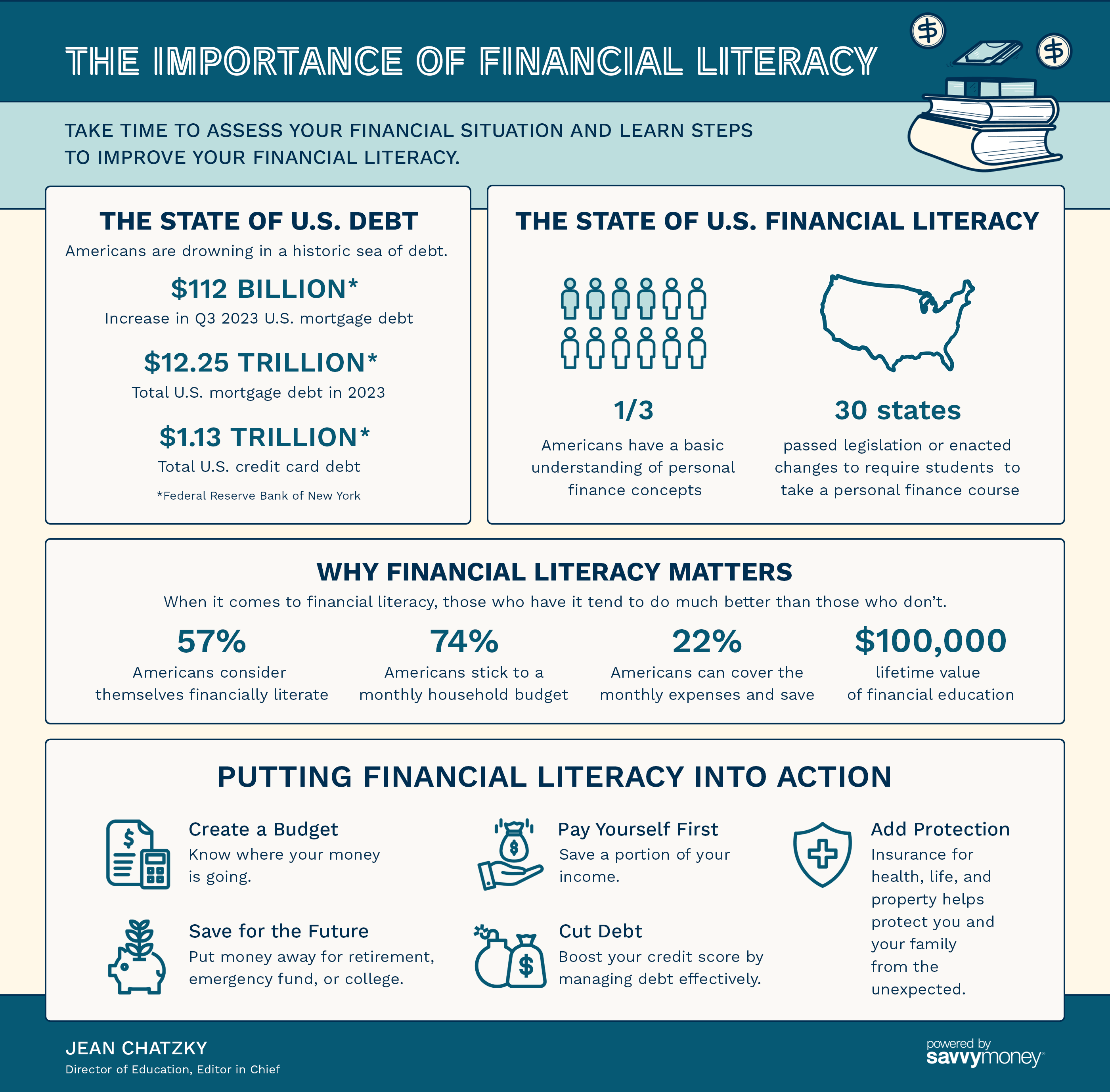

April is here, and with it comes Financial Literacy Month – a time dedicated to empowering individuals with the knowledge and tools they need to make informed financial decisions. At State Bank, we’re excited to celebrate this month by offering SavvyMoney, a revolutionary tool designed to enhance your financial journey and literacy.

In today’s fast-paced world, understanding your finances is more important than ever. That’s why we’re proud to offer SavvyMoney, available completely free with our digital banking services. Whether you’re a seasoned pro or just starting your financial journey, SavvyMoney is here to help you take charge of your financial well-being.

So, what exactly is SavvyMoney, and how can it benefit you? Let’s dive in:

Credit Score Education: Understanding your credit score is crucial for making sound financial decisions. With SavvyMoney, you’ll gain access to a wealth of educational resources that will deepen your understanding of credit scores and financial management. Whether you’re looking to improve your credit or maintain a healthy score, SavvyMoney has you covered.

your understanding of credit scores and financial management. Whether you’re looking to improve your credit or maintain a healthy score, SavvyMoney has you covered.

Credit Goals and Action Plans: Setting financial goals is the first step towards achieving financial success. SavvyMoney allows you to set achievable goals and create action plans to improve your credit health. Whether you’re aiming to pay off debt, increase you credit score or save for a big purchase, SavvyMoney provides the tools and guidance you need to succeed.

Financial Checking Budgeting and Savings Tool: Effective budgeting is the cornerstone of financial stability. With SavvyMoney’s integrated budgeting and savings tools, you can easily track your spending, set budgets and monitor your progress towards your financial goals. Say goodbye to financial stress and hello to peace of mind.

Credit Score Simulator: Ever wondered how a financial decision might impact your credit score? With SavvyMoney’s credit score simulator, you can visualize the potential impact of your decisions before making them. Whether you’re considering opening a new credit card, taking out a loan, or paying off debt, the credit score simulator empowers you to make informed choices that align with your financial goals.

SavvyMoney is more than just a financial tool- it’s a game changer for anyone looking to improve their financial literacy and take control of their financial future. Whether you’re looking to build credit, save money, or achieve your financial goals, SavvyMoney has the tools and resources you need to succeed.

This Financial Literacy Month, join us in celebrating by enrolling in SavvyMoney and taking the first step towards a brighter financial future. Your journey to financial wellness starts here.

State Bank is committed to empowering our customers with the knowledge and tools they need to achieve their financial goals. Ready to take control of your finances? Enroll in SavvyMoney today!